GRE

June 15, 2018

GRE

Global Risk Exchange, HONG KONG

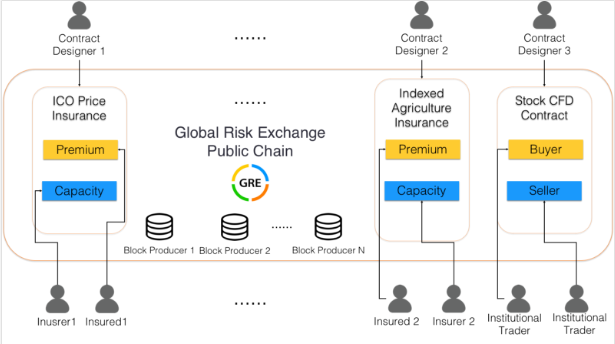

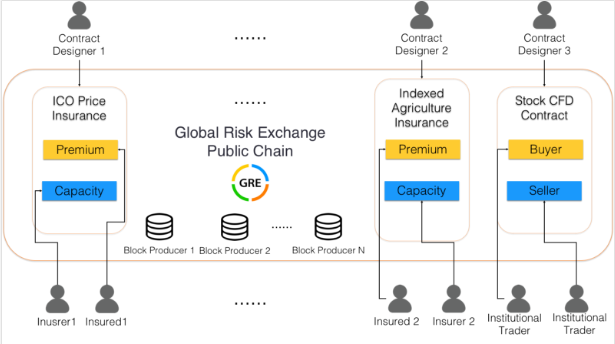

Global Risk Exchange (or "GRE") is a blockchain based, decentralized and open global risk exchange market, with the purpose of helping individuals, companies and organizations to access and trade and manage their risks. GRE completely reconstructed traditional risk management tools(insurance and derivative contracts) in a decentralized way, and will become the underlying operation system to support insurance and derivative transactions in the era of blockchain. GRE aims to build the infrastructure and trading platform for risk management industry in the blockchain driven world in the near future, by providing a fundamental protocol for the creation of risk events, pricing, trading, information collection and oracles to verdict specific risks. It will enable individuals and institutions around the globe to achieve risk and return equilibrium.

First of all, GRE democratize the creation of risk management tools using blockchain based smart contract and orcales, enabling any individuals and institutions who has risk management needs to create, trade and shift risks to others who are willing to take on those risks on the blockchain. It’s a platform where risk management policies and transactions are driven by real demands, where individualized and fragmented risk coverages are made possible, and insurance protections are made agile.

Secondly, GRE leverages a blockchain based decentralized exchange to help participants in the risk management contract: insured(who pay for premium and sell risks), insurer(who receive premium and take on other people's risks) and contract designer(who measures individual risks and design the contract), transact and profit from their own information and understanding of risks. The market price of the risk contract represents the market consensus and the wisdom of the crowd, which is the best measurement of the risk at the moment.

Thirdly, GRE enables a much larger base of insurance capacity providers other than traditional insurance companies and reinsurance companies, which are centralized, tightly regulated and capital intensive. Those new capacity providers can bring more liquidity and information to GRE platform and can profit from GRE by taking on various kinds of risks they understand, while making the whole risk exchange market more efficient and liquid by bringing down the entry barrier for both insured and insurer, maximizing liquidity and information flow.

WHO NEED US ?

- The Insured

This group of users are the individuals and corporations in the real world who want to buy risk management contract(provide premiums) to hedge their risks - Contract Designer

Provide professional risk management expertise for GRE community and can publish risk management contracts after community review and earn fees based on transaction fees collected from trading this contract. - Insurer

This group of users are usually insurance and re-insurance companies and insurance-linked securities investors. They earn premiums from the risk management contract and take the risk transferred to them

GRE Ecosystem

In GRE ecosystem, there are 5 roles, namely underwriter, insured, insurer, GRE platform and block producers

- Contract Designer

Underwriters in GRE ecosystem could be the actuary or product manager of a real-world insurance company, who is responsible for designing terms of risk management contracts, as well as calculating the probability of various kinds of risks and its corresponding premium rate. The role of underwriter is to provide insurance expertise to GRE, which can be any individual or institution with actuarial capability. Underwriters will be rewarded a portion of the transaction fees derived from own risk management contract after community review. - The Insured

This group of users in GRE are the individuals and institutions in the real world who want to buy risk management contract to hedge their risks. They shift their own risks away to others who are willing to take them at the cost of premiums and will be compensated when that risk actually happens. - Insurer

Insurers in GRE ecosystem can be real-world insurance companies, reinsurers and ILS investors. They accept the risks transferred by the insured, assume the risks passed on by the insured, and pay the corresponding liabilities when the risks occur. They provide their insurance capacity to GRE platform and are rewarded with a portion of transaction fees for providing insurance capacity and liquidity to the system. - GRE Platform

The GRE platform charges a certain fee for each risk management transaction and injects it into the foundation development fund for subsequent platform development and maintenance

- Supporting the technical development of the GRE blockchain platform, selecting and introducing major partners and actively developing the GRE community

- GRE Foundation will be responsible for community development, incentives design, legal affairs and compliance

- Responsible for the design of the smart contract, allow community developers to submit the code changes and bugs, establishing a fair and reasonable evaluation mechanism

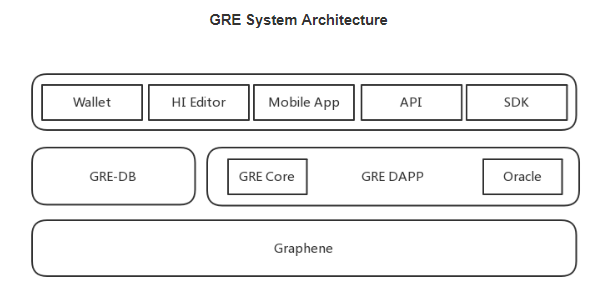

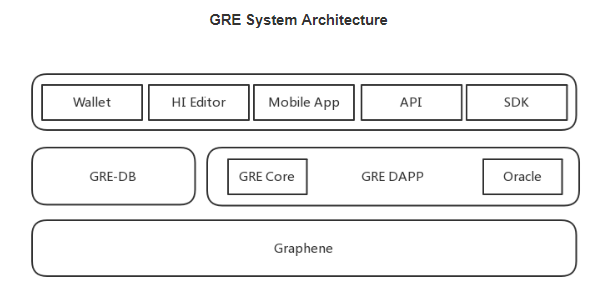

GRE System Architecture

GRE is a decentralized, open-source global risk exchange and the platform is built on Graphene blockchain library.

Project Budget

- Core Development, 40%

This part of fund will be used for the development of GRE public chain, smart contract and user interface to elevate user experience of GRE contract markets and other functionalities. This fund will pay for personnel and software and hardware costs. - Security, 10%

GRE team will continiously invest in security to ensure safety of users' funds. We will conduct security audit for public chain, wallet and contracts and every major launch will have to pass security audit first and then deploy to main net. - Operation, 15%

To ensure efficient and stable operation of GRE platform, we will recruit professional operation, customer service and management team to support our public chain, contract market and wallet. - Marketing and PR, 15%

We will use this part of fund for media and marketing activities to let more community members and people know about GRE and participate in our community. - and Compliance, 5%

Blockchain is a emerging industry and laws and regulations in various countries have a hug impact on our platform. Compliance is crucial to GRE's success. We will actively seeking compliance structures such as licenses and regulation sandbox and will allocate corresponding budget for that. We will also build internal and outisde legal process to meet the requirements of various countries.

ROADMAP

- 2018 Q1

GRE-Core development

Centralized Oracle development

Demo of GRE App development

Demo version of App-server development - 2018 Q2

HI editor development

Mobile wallet development

Official App development

Continue GRE-Core and Oracle development - 2018 Q3

Development of Alpha Edition

Provide API & SDK

Security audit

GRE test running - 2018 Q4

Basic RDHI library content production

KYC related development

Security audit

Complete migration to public chain

Formal operation of the GRE primary market - 2019 Q1

Development of secondary market editor

Content production of secondary market base

Secondary market security audit

Complete development of the Alpha version of secondary market

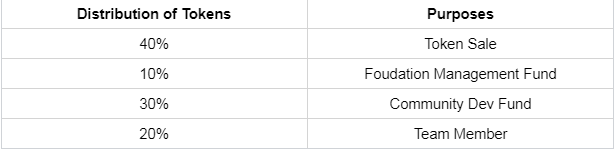

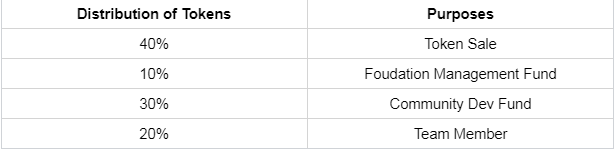

RISK Token Distribution Plan

- Token Sale

GRE will allocate 40% of all tokens to community members through token sale. Those tokens will be distributed through private placement, public sale and the funds raised from token sale will be used in GRE platform development, recruiting, marketing and operation. Those tokens allocated not used for token sale will be injected into community development fund and will unlock according to lock-up rules.

Chinese citizens will not be allowed to participate in RISK token sale plan.

Any Amercian citizen, permanent resident, or green card holder will not be allowed to involved in RISK's token sale, unless someone is a qualified investor after being certified in accordance with relevant U.S. securities laws. - Foundation Management Fund

10% of all tokens are allocated for foundation managed fund and will be used for GRE Foundation's operation. Those tokens will release in the next 2 years with 25% tokens are unlocked in the first 6 months after project initiation and 25% to be unlocked every half year thereafter. - Community Development Fund

30% of all tokens are allocated for community development fund and will be used for projects and local partner supports, marketing, ecosystem incubation and investments, developer commnunity building, business cooperation, and research. Those tokens will release in the next 2 years with 25% tokens are unlocked in the first 6 months after project initiation and 25% to be unlocked every half year thereafter. - Team member

20% of all tokens are allocated for founding team, development team and early supporter of GRE for their contributions to the community, product launch and operations. Those tokens will release in the next 2 years with 25% tokens are unlocked in the first 6 months after token listing on any crypto exchange and 25% to be unlocked every half year thereafter.

More information about GRE you can find here

Website:https://www.gref.io/

Github:https://github.com/grefoundation

Telegram:https://t.me/GREF_EN

Twitter:https://twitter.com/GRE_RISK

Facebook:https://www.facebook.com/GRE.risk/

Github:https://github.com/grefoundation

Telegram:https://t.me/GREF_EN

Twitter:https://twitter.com/GRE_RISK

Facebook:https://www.facebook.com/GRE.risk/

Author : Yanadimaz10

My ETH : 0x6C6e23fE2BC0afC31f5B48b6F7E430436b716Bc2

Komentar

Posting Komentar